massachusetts real estate tax rates by town

The exact property tax levied depends on the county in Massachusetts the property is located in. Property tax is an assessment on the ownership of real and personal property.

16 Evans Rd 2 Marblehead Ma 01945 1 Bed 1 Bath Marblehead Real Estate Sales House Prices

Barnstable Town MA Sales Tax Rate.

. For more details about the property tax rates in any of Massachusetts counties choose the county from the interactive map or the. And the average home value of 256432. Framingham MA Sales Tax Rate.

Massachusetts property tax rates for 2013 by city and town. Fiscal year 2021 tax rate 1465 per thousand. The highest tax bills in Massachusetts are in many communities outside of Boston within the 495.

Town Residential Commercial Industrial Year. Counties in Massachusetts collect an average of 104 of a propertys assesed fair market value as property tax per year. Massachusetts has one of the highest average property.

7 is 1527 per 1000 in. 372 rows The rate for residential and commercial property is based on the dollar amount per every 1000. 73 rows Cambridge has a property tax rate of 592.

Click here for a map with additional tax rate. A local option for cities or towns. Zip Assessors Phone City Town Residential Commerc.

351 rows 2022 Massachusetts Property Tax Rates. Massachusetts property tax rates by town and city. 2022 Berkshire County Massachusetts Property Tax Rates.

An owners property tax is based on the assessment which is the full and fair cash value of the property. Look Up Any Address in Massachusetts for a Records Report. The town of Rowe in northwestern Massachusetts near Vermont has an annual tax bill of 1166.

Middlesex County collects the highest property tax in Massachusetts levying an average of 435600 104 of median home value yearly in property taxes while Berkshire County has the lowest property tax in the state collecting an average tax of 238600 115 of median home. Tax amount varies by county. Apr 11 2011 Updated Dec 17 2012 640am EST.

Ad Online Property Taxes Information At Your Fingertips. Framingham Center MA Sales Tax Rate. Massachusetts has 14 counties with median property taxes ranging from a high of 435600 in Middlesex County to a low of 238600 in Berkshire County.

The annual real estate tax for the home in this example is 4440. Each year local assessors in every city and town in Massachusetts have a constitutional and statutory duty to assess all property at its full and fair cash. 2022 Massachusetts Property Tax Rates.

At 136 the average effective property tax rate in Plymouth County is the on the higher side. The median tax rate for FY2022 is 1285 down from 1340 in FY2021 while the average tax rate is 1322 down from 1380. 104 of home value.

Comparing Massachusetts Towns with the Highest. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. Still some homeowners could be paying more.

For example in the city of Plymouth the total rate for 2021 is 1616 per 1000 in assessed value. Brockton MA Sales Tax Rate. State Summary Tax Assessors.

Or put another way the highest tax rate in Essex County is double that of the lowest. That rate will vary depending on what city or town you pay taxes to though. Chicopee MA Sales Tax Rate.

See Results in Minutes. Data Analytics and Resources Bureau Tax Rates by Class Data current as of 07042022. The highest taxed town Wenham has a rate 52 higher than the County median while the lowest Rockport is 24 below the median.

The median residential tax rate for the 344 communities with available information as of Jan. This was based on property values associated with real estate market trends in 2020. In December 2022 it is expected that the City Council will vote on this years new tax rate based on how the real estate market was performing in 2021.

Barnstable Town MA Sales Tax Rate. Changes in the federal tax. Open Save Print 2022_Property_Tax_Rates 2022 Rates Per 1000 assessed value.

Most towns in western Massachusetts with assessed home values lower than the state average have the lowest tax bills in the state such as the town of Hancock with an average annual tax bill of just 764. Tax rates are stated as per 1000 of assessed value. Thus you need to first divide the assessed value by 1000 and then multiply that result by the tax rate.

Brookline MA Sales Tax Rate. Barnstable MA Sales Tax Rate. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown.

Cambridge MA Sales Tax Rate. Longmeadow has the highest property tax rate in Massachusetts with a property tax rate of 2464. The median property tax rate dropped about 15 percent from 1557 per 1000 of assessed value in 2018 to 1534 in 2019.

Residential tax rates decreased on average in Massachusetts for 2020. Massachusetts property real estate taxes are calculated by multiplying the propertys. Massachusetts property-tax rates in 2018 by town and city Hey employers heres how Beacon Hill might spend your money in 2020.

To calculate the real estate tax for a home you will need the current assessed value and the residential tax rate. Property tax is an assessment on the ownership of real and personal property. Boston MA Sales Tax Rate.

Massachusetts Property and Excise Taxes. What was the difference in real estate values in Gardner in FY2022 versus FY2023. 750000 divided by 1000 750.

Hypotec Is Here To Help Take Advantage Of Our 10 Years Experience To Find You Low Refi Rates And Real Estate Infographic Real Estate Advice Real Estate Tips

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Property Tax Calculator Smartasset

Massachusetts Estate Tax Everything You Need To Know Smartasset

A Guide To Estate Taxes Mass Gov

Cole Memorial Chapel At Wheaton College Ma Wheaton College Wheaton College Campus

Illinois Is The Worst State For Middle Class Families Illinois Middle Class Tracking Income

400 Ocean Ave Marblehead Ma 01945 Mls 72797649 Zillow Marblehead Colonial Exterior Marblehead Massachusetts

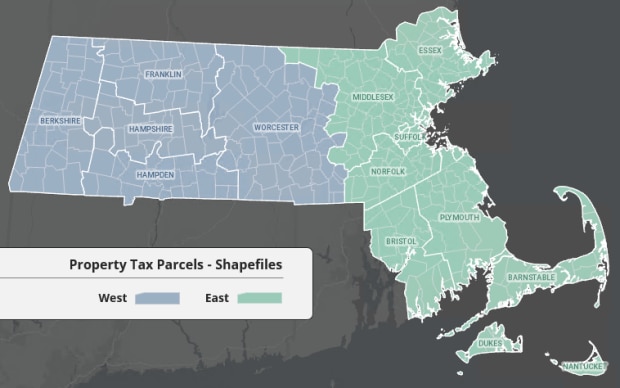

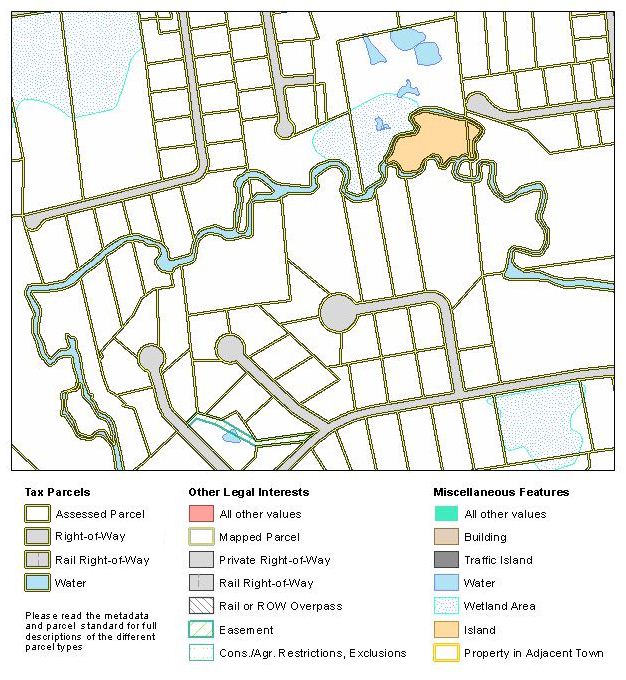

Massgis Data Property Tax Parcels Mass Gov

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

Closing Lawyer Massachusetts Moody Knoth Estate Planning Residential Real Estate Home Mortgage

Real Estate Prospecting Letter Template Real Estate Agent Etsy In 2022 Real Estate Agent Real Estate Estate Agent

B2627 Posted To Instagram Taxes Don T Have To Be Scary I Can Sell Your House And Save You Money At The Same Selling House Tax Deductions Selling Your House

Massachusetts Interactive Property Map Mass Gov

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

Massachusetts Property Tax Calculator Smartasset

Massachusetts Property Tax Rates In 2018 By Town And City Boston Business Journal Property Tax Massachusetts Business Journal

Massachusetts Estate Tax Everything You Need To Know Smartasset